Land Transaction Tax (LTT) threshold to increase

As the Welsh government seeks to encourage the property market following the disruption caused by Covid-19, they have announced that from the 27th July there will be a temporary increase in the Land Transaction Tax (LTT) threshold until the 31st March 2021.

What is Land Transaction Tax (LTT)?

Land Transaction Tax is the tax paid on property transactions in Wales. It's the equivalent of Stamp Duty in England and Northern Ireland, or Land and Building Transaction Tax (LBTT) in Scotland.

It replaced Stamp Duty in 2018, when it was one of the tax liabilities devolved from Westminster.

How has the LTT changed?

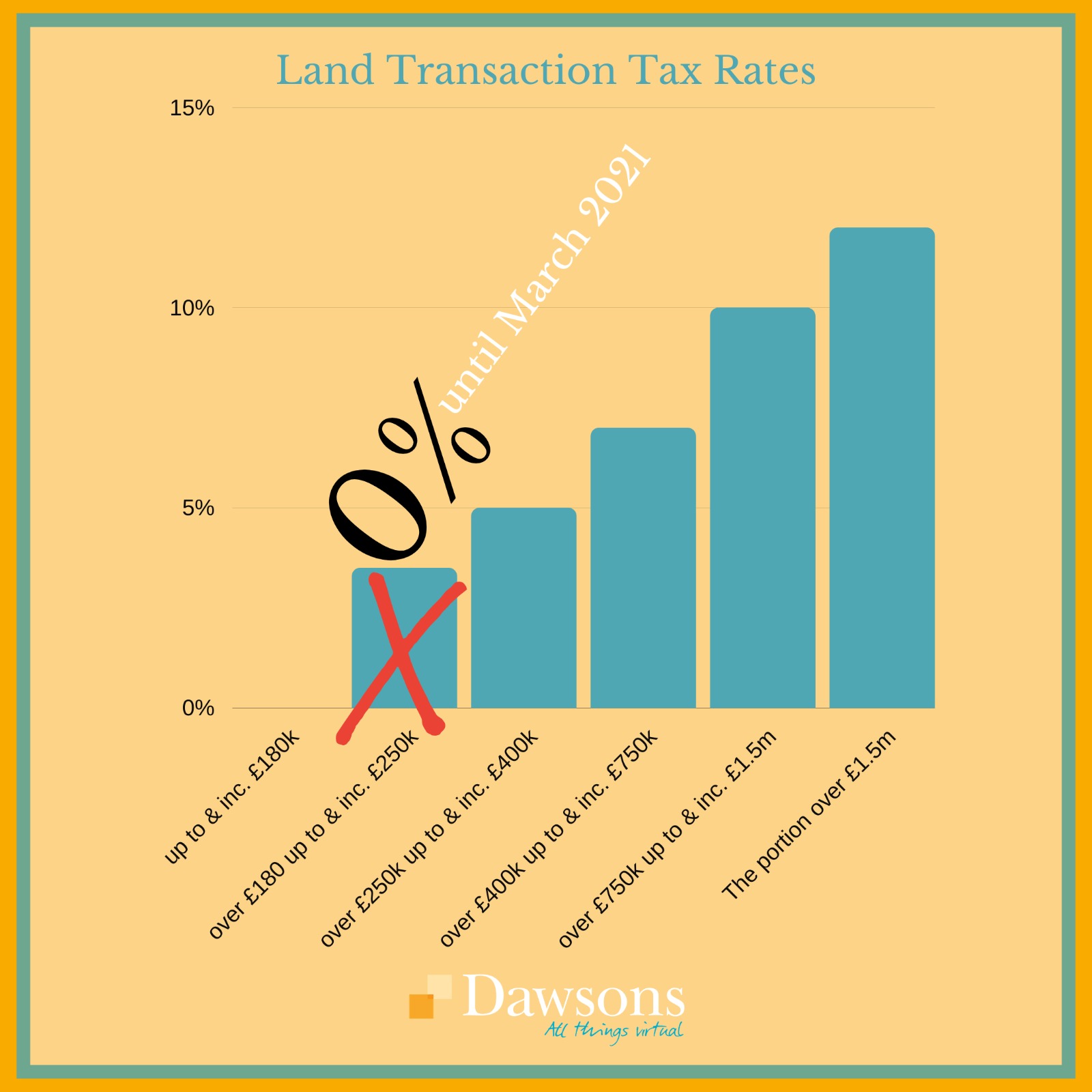

Previously, buyers only paid LTT on the purchase price of properties over £180,000, but the threshold has now been raised to £250,000. This means buyers pay no LTT up to the value of £250,000.

It is worth noting, however, that the raise in the LTT threshold with have no effect on those purchasing second homes or buy-to-let properties who have to continue paying the existing buy-to-let rates.

LTT is worked out on a tiered system, meaning that the higher the purchase price, the higher the percentage of tax buyers must pay. We've put together a handy graph demonstrating this, and how much you could save if you take advantage of the increased threshold.

If you're looking to take advantage of the threshold increase, please do get in touch. We're here to help you find your dream home.